Studio Alliance Masterclass: The Future of Flexible Workspaces

Recently, we had the opportunity to attend an important session on flexible workspaces with Emma Swinnerton (Cushman & Wakefield, EMEA Head of Flexible Workspace).

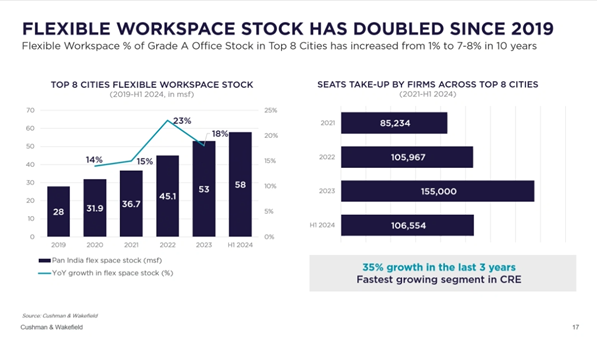

Fortune Business Insights reports that the flexible workspace market was valued at USD 30.72 billion in 2022 and is projected to reach USD 96.77 billion by 2030. Evaluating the opportunities offered by this rapidly growing market and its impact on our industry is of great importance to prepare our business models for the future

In this session, participants discussed coworking trends, market dynamics, and growth opportunities in Europe.

Post-Pandemic Office Use and the Rise of Flexible Workplaces

After the pandemic, working dynamics have undergone a radical change. The transition from the traditional office model to hybrid workinghas caused employees and companies to redefine their office needs. Research shows that more than 50% of employees in the EMEA region prefer to work in the office 1-4 days a week.

Companies are looking to make their offices more flexible, scalable and cost-efficient. Large companies and startups increasingly prefer flexible workspaces because they provide more flexibility than traditional leases.

Especially large corporate companies are turning to flexible office solutions instead of entering into long-term lease agreements considering future uncertainties. This makes flexible workspaces an increasingly important business model for both investors and property owners.

Global Trends in Flexible Workplaces

In line with the information provided by Emma Swinnerton, recent trends in the flexible workspace market in Europe can be summarised as follows:

Flexible Workspaces Become the Cornerstone of the Hybrid Work Model

Companies now offer their employees not only office or telecommuting options, but also the opportunity to use different flexible spaces. Experts predict that flexible workspaces will become a standard in large office buildings.

Location of Offices Gains Importance

Although many believed that people preferred workspaces close to their homes during the pandemic, observations show that office demand has largely returned to central business districts (CBD).

Especially in big cities, buildings that offer flexible office spaces are more in demand than others. Tenants prefer buildings with flexible workspaces over those without, even in the same location.

Property Owners Invest More in Flexible Office Management

Property owners are now directly managing flexible workspace operations, which were previously handled by third-party operators. This is starting a new wave of transformation in the property sector.

Management Models Are Changing

Instead of traditional long-term leases, the ‘Management Agreements’ model comes to the fore. In this model, the majority of the risk is borne by the property owner, while the operator works on a revenue-sharing basis.

In addition, hybrid rental models are emerging. Here, in addition to a fixed rental price, a revenue sharing based on the performance of the flexible space is applied.

Flexible Workspaces Market Overview by Country

United KingdomIn the UK, which has the most mature flexible office market in Europe, the market is still growing and management agreements are becoming increasingly common.

Germany: The flexible office market in Germany is distributed among major cities such as Berlin, Munich and Frankfurt. However, experts note that the growth rate is slower than in the UK due to low vacancy rates.

Spain: In Spain, the growth of flexible offices is mostly driven by local initiatives and management agreements are not yet widespread.

India: In India, one of the fastest growing flexible office markets in the world,demand is largely based on the ‘managed space’ model. Global companies are turning towards flexible offices in this model due to the advantage of rapid scalability.

ESG (Environmental, Social and Governance) and Flexible Offices

ESG is becoming one of the key elements determining the future of the property sector. Particularly in European cities, flexible working spaces actively contribute to boosting economic vitality.

However, it was emphasised that there is still room for improvement in terms of social inclusion. Suggested strategies for this include creating flexible office spaces that appeal to more diverse work groups and diversifying pricing strategies.

New Opportunities for Fit-Out Companies

The rise of flexible working spaces offers a great opportunity for companies operating in the field of architecture and interior design.

Flexible office operators have three basic expectations for successful fit-out projects:

Space efficiency: Optimised designs that provide more desk and work space.

Cost-effective solutions: To develop cost-effective fit-out projects while maintaining aesthetics and functionality.

Sustainability orientated designs: Environmentally friendly materials and energy efficient solutions in accordance with ESG criteria.

Conclusion: The Future of Flexible Workplaces

The workspace market continues to grow rapidly and is becoming one of the most important trends shaping the future of the business world.

Flexibility, scalability and ESG compliance are more important than ever for companies, property owners and business development professionals.

Businesses that follow this trend will gain competitive advantage and strengthen their market position with the right collaborations and strategies.