What Changed in the European Office Market in 2024? Rents, Investments and Prospects

In the first half of 2024, the European office market witnessed significant changes driven by changing economic conditions, evolving tenant behaviour and emerging investment trends. In this article, we review the main market trends, rental and investment dynamics and key prospects shaping the office market in Europe, focusing on different cities and regions.

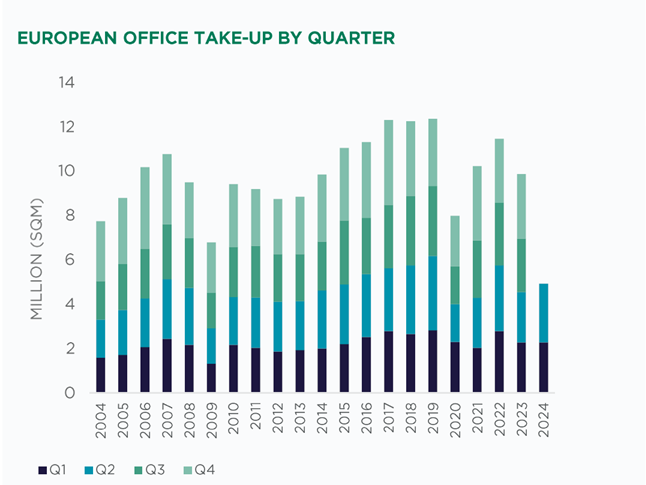

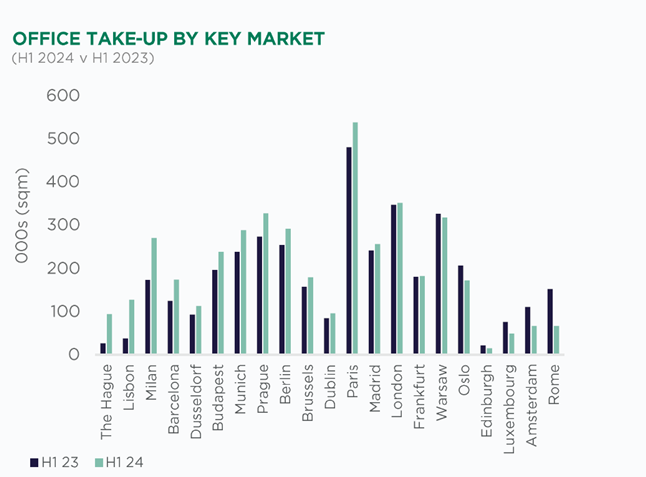

Leasing Activities Revitalised

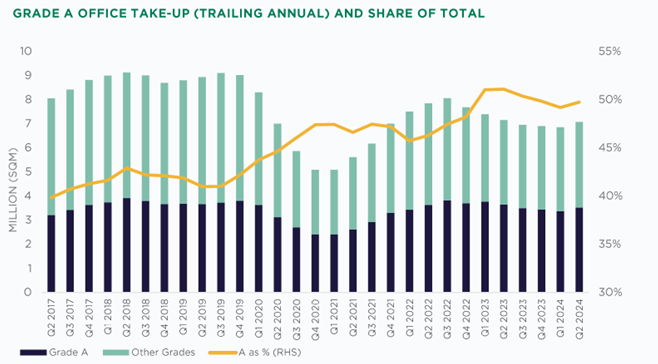

In the first half of 2024, European office leasing activity showed a significant increase compared to the same period last year. This recovery is driven by increased demand for Class A office space, especially those with the highest quality standards. Tenants are willing to pay more for these premium spaces that meet ESG standards and offer a wealth of amenities. Grade A leases account for half of all leasing activity, with strong demand in cities such as London, Prague and Berlin.

Economic Indicators: Resilience to Challenges

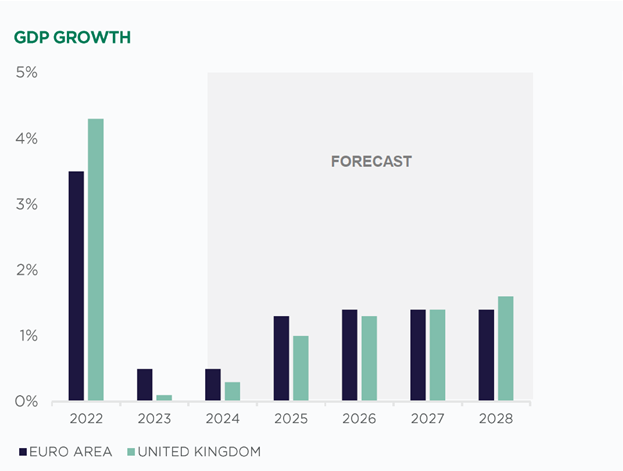

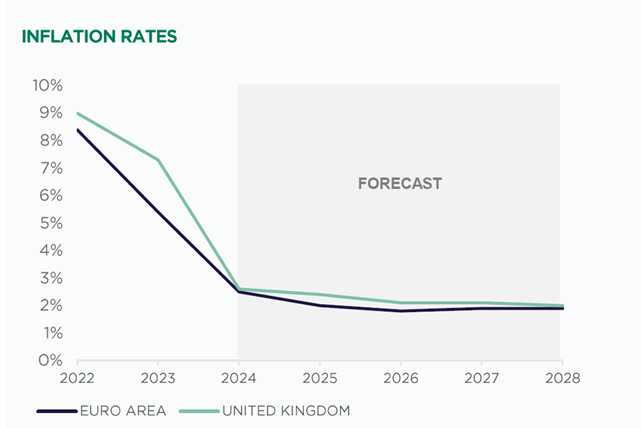

European economies managed to recover from a deep recession and achieved positive growth figures in the first quarter of 2024. GDP in the euro area and the United Kingdom rose by 0.3% and 0.7% respectively. However, large economies such as Germany, France and Italy are performing weaker than other European countries such as Spain and Poland. Inflationary pressures eased; inflation in the euro area slowed to 2.5% in June, but the rate varies across countries.

Leasing Increase: Orientation to Quality Areas

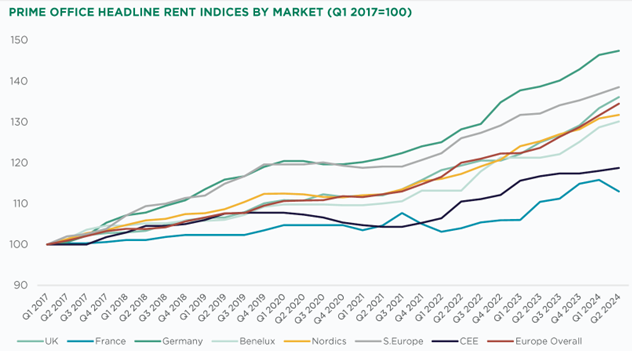

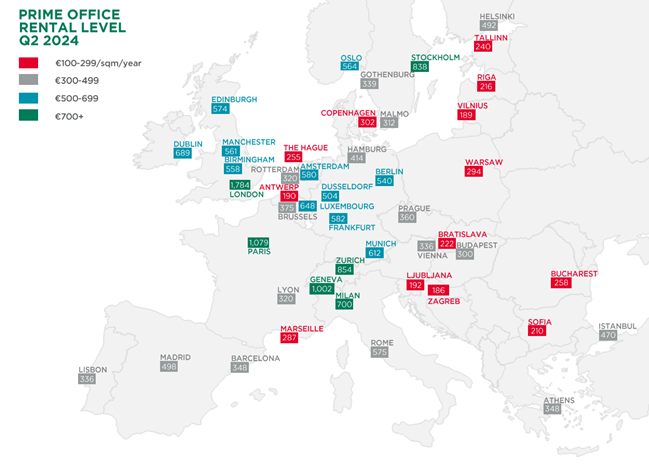

In the first half of 2024, prime office rents across Europe increased by 5.5 %, one of the strongest periods of sustained growth since 2008. Rental growth was particularly strong in the UK, Benelux and Germany, while Southern Europe also performed well. Increasing construction costs and the ongoing competition for centralised, amenity-packed space drove rents higher. However, taking five-year inflation into account, rents are still relatively affordable.

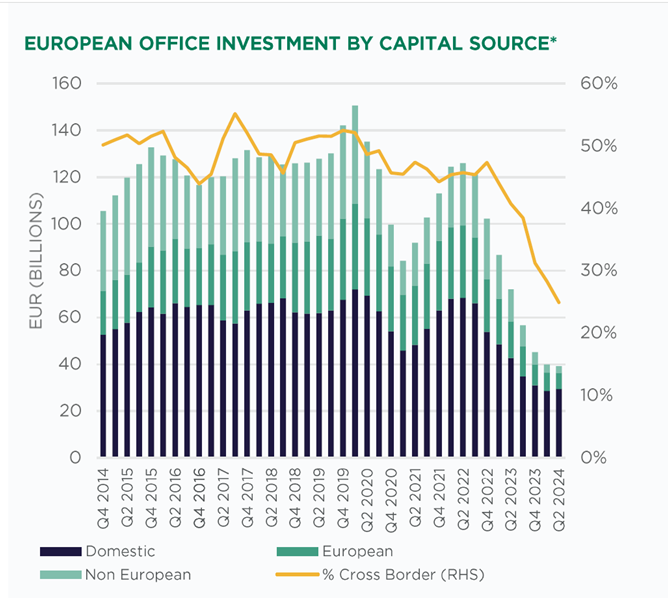

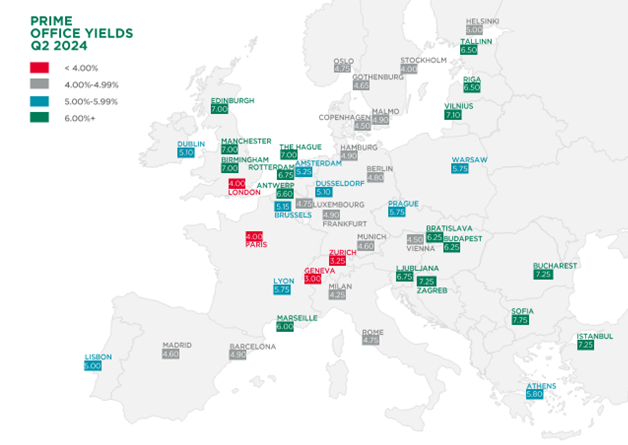

The Investment Market: Finally a Change

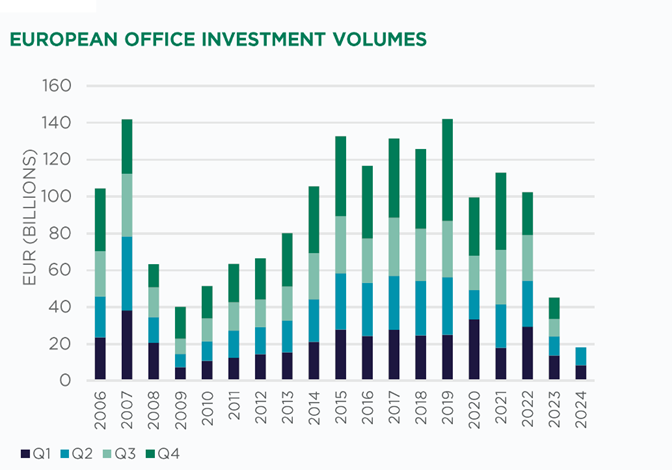

2024’ün ilk yarısında Avrupa ofis yatırım piyasası yavaş yavaş toparlanmaya başladı, ancak hala önceki yılların seviyelerinin gerisinde kaldı. Ofis sektörüne yapılan yatırım, 2009’dan bu yana en düşük seviyeyi gördü ve 18,1 milyar euro ile bir önceki yıla göre %25’lik bir düşüş yaşandı. Ancak, piyasa duyarlılığı değişmeye başlıyor; 2024’ün ikinci yarısı ve 2025’te daha güçlü bir talebin yatırım faaliyetlerini canlandırması bekleniyor. Yatırımcılar, özellikle ESG standartlarını karşılayan varlıkları yeniden kullanma veya yeniden konumlandırma fırsatlarına odaklanıyor.

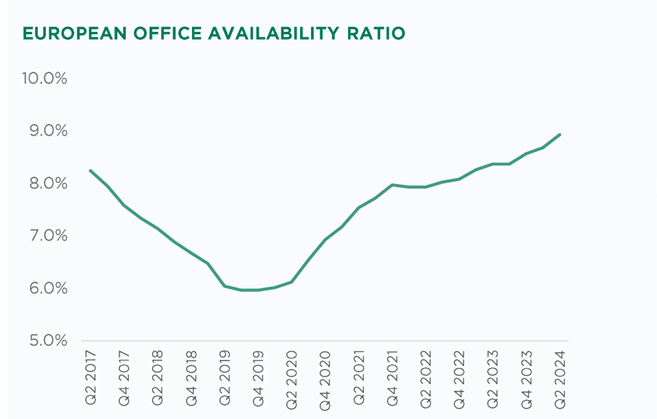

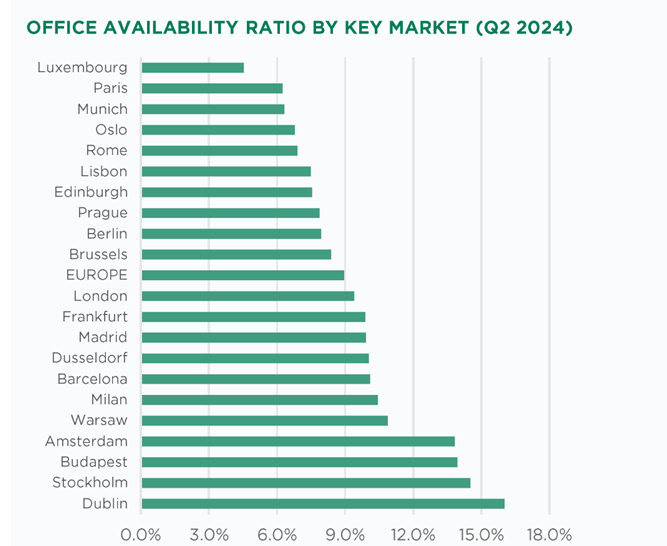

Supply and Developments: Balancing Demand

The total amount of available office space across Europe increased by 5% to 25.2 million square metres. However, despite this increase, supply is still below the peak levels seen after the 2008 Global Financial Crisis. Construction activity has also increased modestly, with 12.3 million square metres of office space under construction at the end of the second quarter of 2024. While the risk of oversupply is low, especially in major European cities, the market is closely monitoring demand dynamics.

Expectations for the Second Half of 2024 and Beyond

The European office market is showing signs of recovery, with continued demand for quality, central, amenity-packed and ESG-compliant assets. Prime centrally located prime space will continue to see rental growth, but investors are cautious in the post-COVID era. Investors seeking value creation opportunities will be more active in the second half of 2024 and 2025. With economies stabilising and interest rates falling, prime assets are expected to rebound more strongly.

In conclusion, despite the challenges, the European office market is gaining upward momentum and key trends in leasing, investment and development are shaping its future. Success in this changing landscape will continue to depend on quality, sustainability and advanced technologies.

Source: Cushman & Wakefield. “European Office Market Update H1 2024.”